First Class Tips About How To Buy An Reo

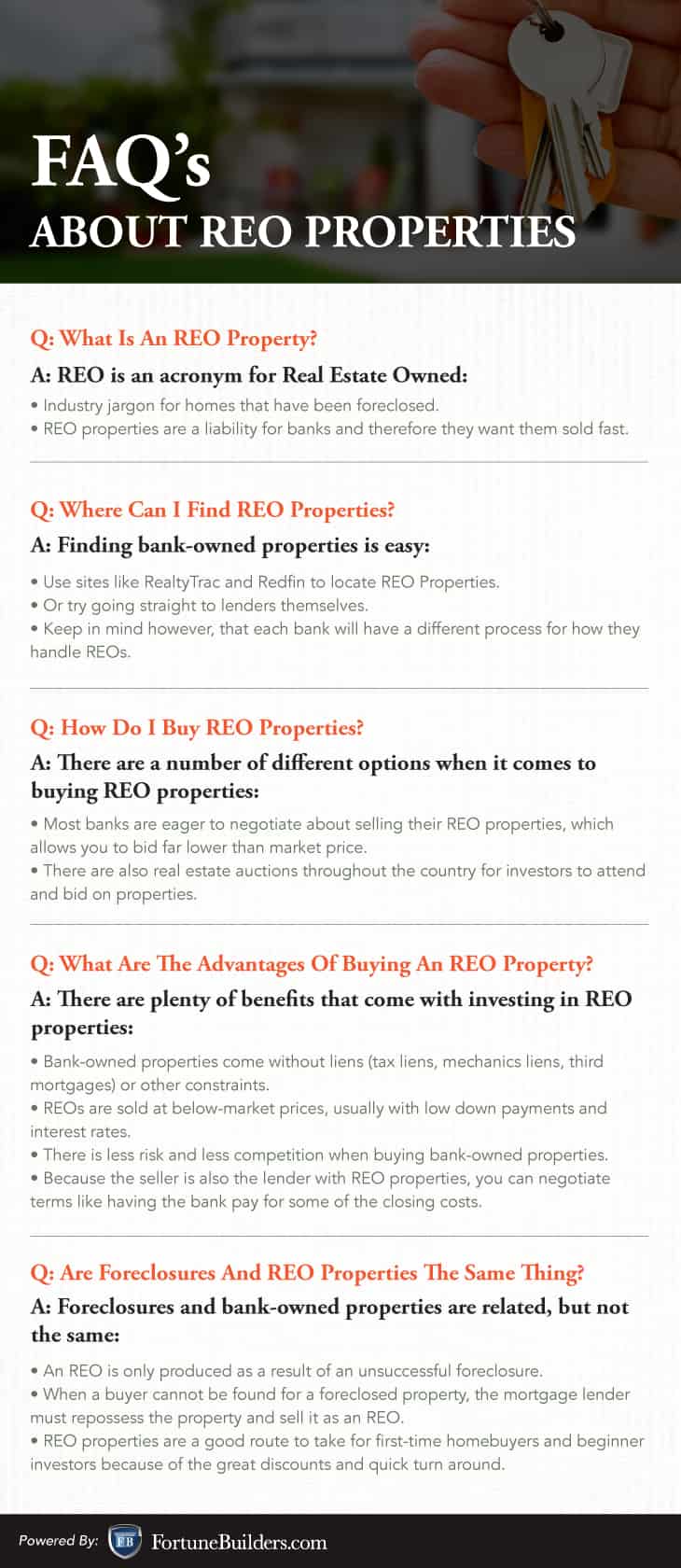

Start the hunt for reos.

How to buy an reo. In fact that it’s impossible to tell which ones have. But you might find the same listings through free sites. It usually does not cost you to hire a buyer's agent.

The reality is that bank reos are often listed at least 10% or more below current market values, and these homes typically sell for at least 95% of that price. Before you get too far into the process, take a look at the properties. A good place to start when looking for an reo property is to search publicly available listings from the department of housing and urban development (hud) and other.

To file a foreclosure, a. Here's how you can still find deals as an investor. Bank real estate owned (reo) properties.

The first, buying a short sale, is to buy a property from the homeowner before is foreclosed. A conventional mortgage is typically available to people with good to great credit. A quick look around the real estate industry, and you’ll find that there are countless reo homes for sale.

Here is an extensive list of different ways buyers may finance an reo property: Ticket prices may fluctuate, based on demand, at any time. There are two types of auctions that may occur, a public foreclosure auction or public auction through an auction.

From there the property is typically turned over to an asset manager and put on the. The next sale will begin on thu, sep 22 @ 10:00 am pdt. The buyer's agents may ask you to sign a buyer's broker agreement, which will specify the agent's duties.